- Excel ACCRINT Function

- Browse Terms by Letter

- Calculating Bond Accrued Interest: Which Method Should You Use?

They all use what's called a "day-count fraction" or DCF.

Excel ACCRINT Function

This refers to the number of days in a month or year, a number that is standardized for any given bond. For example, many bonds calculate interest by allocating 30 days to a month and days to a year. Others may use the actual number of days in a month and year. To calculate your accrued interest, you must first know which of these methods is used for your bond and then do a few simple calculations.

- Your Answer!

- lucero olive oil coupon codes;

- philips sonicare coupon canada;

- What is Accrued Interest?.

A is the accrued interest you are solving for. P is the par value of the bond. C is the annual coupon rate or interest rate. F is the payment frequency. D is the number of days since your last coupon. T is the total number of days in a payment period. For more advice from our Certified Public Accountant reviewer, including how to calculate interest in Excel, keep reading! Categories: Investments and Trading Passive Income. Learn why people trust wikiHow. There are 8 references cited in this article, which can be found at the bottom of the page. Determine the day-count convention on your bond.

The day-count convention on your bond is defined in the accompanying indenture contract. Other bonds, especially U. In practical terms, the convention used will make very little difference in terms of interest earned.

- present value coupon bond formula;

- coupons.com printer app download;

- How to use the Excel ACCRINT function | Exceljet!

- iphone ipad deals carphone warehouse;

- Accrued interest!

- lease deals lexus rx 350;

- ASX bond calculator.

Double-check your bond indenture to be sure. Confirm the interest rate and payment frequency on your bond.

Your interest rate, also called the the coupon rate, specifies the amount of interest you earn on the bond annually as a percentage of your par or "face" value. The payment frequency signifies whether your bond pays interest once a year or more often. Bonds typically pay interest either annually or semi-annually once or twice per year.

- Accrued Interest!

- Primary Sidebar!

- coupon crazy cat lady;

- Glossary of Municipal Securities Terms.

- discount coupons jockey underwear;

Find when the most recent coupon payment was made. Search your records to see when your bond made its latest coupon payment. This information is available from the financial institution that sold you the bond. Calculate how many days have passed since the most recent coupon-paying day. This will depend on your DCC, as the passage of days is calculated differently in each type of bond. You would simply multiply 2 x 30 and use 60 days in your calculations, regardless of how many days there actually were in the elapsed months.

Confirm the face or par value of your bond. This is the amount paid to the holder of the bond at maturity when the interest payments stop. Note that the par value may be more or less than what you actually paid for the bond originally. Market price is affected by the existing rate environment and the bond issuer's creditworthiness. That would be the par value even if you paid slightly more or less for it. Know the equation for bond accrued interest. This is the figure you are solving for. For our purposes it should be expressed as a decimal.

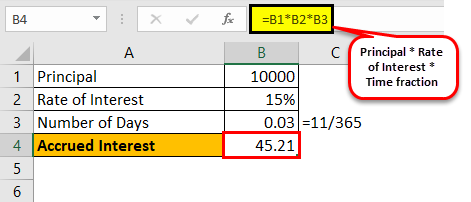

Simply take the interest rate shown in the bond indenture and divide by to produce the decimal equivalent. This would be 2 for semi-annual payments or 1 for annual ones. This would be for annual payments and for semi-annual ones. Input your variables. Simply put all of the above information into the appropriate places in the equation. Double-check everything to make sure it's expressed correctly. Two months 60 days have passed since the last payment, so "D" is Find the period interest rate.

Browse Terms by Letter

This simply means dividing the coupon rate by the payment frequency. This reflects the interest rate earned in each payment period. In the equation, this is C divided by F. In our example, this calculation would give a rate of 0. Calculate your day-count fraction. Divide the number of days that have passed since the latest payment by the number of days in your current payment period.

This is the final part of the equation. Determine the value of your accrued interest.

Generally, the best way to enter valid dates is to use cell references, as shown in the example. To enter valid dates directly inside a function, you can use the DATE function. To illustrate, the formula below has all values hardcoded. The DATE function is used to supply each of the three required dates:. The basis argument controls how days are counted.

Formulas are the key to getting things done in Excel. You'll also learn how to troubleshoot, trace errors, and fix problems. Instant access. Skip to main content.

Calculating Bond Accrued Interest: Which Method Should You Use?

Return value. Usage notes. Related functions. Good links. Excel Formula Training Formulas are the key to getting things done in Excel. You must have JavaScript enabled to use this form.