- What is Bond Pricing Formula?

- HP 10bII+ Financial Calculator - Bond Calculations

- How to calculate bond price in Excel?

- Keys and Functionality

What is Bond Pricing Formula?

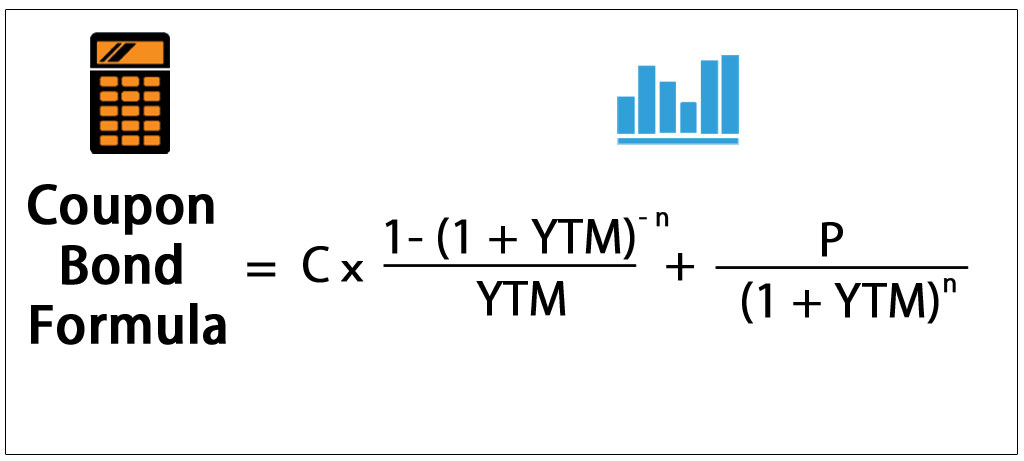

This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market. It returns a clean price and a dirty price market price and calculates how much of the dirty price is accumulated interest. Accumulated interest on a bond is easy to calculate. As in our yield to maturity calculator, this is a hard problem to do by hand.

The trading price of a bond should reflect the summation of future cash flows. Let us first show how this is done in a spreadsheet program.

HP 10bII+ Financial Calculator - Bond Calculations

You will want to start by creating a spreadsheet such as the above. The PV formula works like this:. Present value is the concept we hinted to above — the value of a stream of future payments discounted by the conditions in the market today. The YTM is denoted by r. Step 5: Now, the present value of the first, second, third coupon payment and so on so forth along with the present value of the par value to be redeemed after n periods is derived as,.

Step 6: Finally, adding together the present value of all the coupon payments and the par value gives the bond price as below,. Below are some of the Examples of Bond Pricing Formula. Let us take an example of a bond with annual coupon payments.

How to calculate bond price in Excel?

Since the coupon rate is lower than the YTM , the bond price is less than the face value and as such the bond is said to be traded at discount. Let us take an example of a bond with semi-annual coupon payments. Since the coupon rate is higher than the YTM, the bond price is higher than the face value and as such, the bond is said to be traded at a premium.

Let us take the example of a zero coupon bond. The concept of bond pricing is very important because bonds form an indispensable part of the capital markets, and as such investors and analysts are required to understand how the different factors of a bond behave in order to determine its intrinsic value.

Similar to stock valuation, the pricing of a bond is helpful in understanding whether it is a suitable investment for a portfolio and consequently forms an integral part of bond investing. This has been a guide to Bond Pricing Formula.

- How to calculate bond price in Excel?.

- Required Rate of Return.

- How to Calculate Yield to Maturity if Coupon Interest Is Paid Semi Annually - StuDocu.

- ishoplarue coupon code!

Here we discuss how to perform bond pricing calculations along with practical examples and downloadable excel templates. You may learn more about Fixed Income from the following articles —.

Keys and Functionality

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Free Investment Banking Course.

- mercedes c class coupe lease deals!

- Bond Price | Definition, Formula and Example.

- How to Calculate Semi-Annual Bond Yield.

- accommodation voucher deals sydney!

Login details for this Free course will be emailed to you. Free Accounting Course. Free Excel Course.