- Bond Value Calculator: What It Should Be Trading At | Shows Work!

- Salary & Income Tax Calculators

- Bond Pricing Formula

The expected trading price is calculated by adding the sum of the present values of all coupon payments to the present value of the par value no worries, the bond value calculator performs all of the calculations for you, and shows its work. Since the value of a bond is equal to the sum of the present values of the par value and all of the coupon payments, we can use the Present Value of An Ordinary Annuity Formula to find the value of a bond.

What is the value of one of XYZ's new bonds? In other words, what should the price be?

You can also find the bond price using a spreadsheet to calculate and sum the present values of the par value and all of the coupon payments, like this:. Since the price of bonds trend in the opposite direction of interest rates, the price an investor is willing to pay for bonds tends to decrease as interest rates rise, and increase as interest rates decline.

If this sounds confusing to you, perhaps a simple example will help clear the air. Those two examples should help to explain why interest rates have an inverse relationship with bond prices. And it's a good thing they have this inverse relationship. The underlying reason bond prices rise and fall is to bring the rates of older bonds into line with prevailing rates. Were it not for these price fluctuations there would be no liquidity in the bonds market and very few issuers.

After all, no one would be willing to buy bonds at par value if the bonds were paying lower interest rates than the prevailing rates, and issuers would not issue bonds if doing so would cause them to pay a higher interest rate than if they were to borrow the money elsewhere.

Bond Value Calculator: What It Should Be Trading At | Shows Work!

The more you use the bond value calculator, the more it should become clear that the effects that changing interest rates have on the price of a bond tend to become less and less the closer it gets to its maturity date. This is because the interest rate risk risk of missing out on higher interest rates decreases the closer bonds get to their maturity dates. Move the slider to left and right to adjust the calculator width. Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen.

Moving the slider to the left will bring the instructions and tools panel back into view. Also note that some calculators will reformat to accommodate the screen size as you make the calculator wider or narrower.

If the calculator is narrow, columns of entry rows will be converted to a vertical entry form, whereas a wider calculator will display columns of entry rows, and the entry fields will be smaller in size Select Show or Hide to show or hide the popup keypad icons located next to numeric entry fields.

These are generally only needed for mobile devices that don't have decimal points in their numeric keypads. So if you are on a desktop, you may find the calculator to be more user-friendly and less cluttered without them. Select Stick or Unstick to stick or unstick the help and tools panel. Selecting "Stick" will keep the panel in view while scrolling the calculator vertically. If you find that annoying, select "Unstick" to keep the panel in a stationary position. If the tools panel becomes "Unstuck" on its own, try clicking "Unstick" and then "Stick" to re-stick the panel.

Menu Favs. Data Data record Data record Selected data record : None. Par value Par value Par value Par value : Par value: Enter the par value of the bond only numeric characters and a decimal point, no dollar sign or commas. Learn More.

Salary & Income Tax Calculators

Coup rate Coupon rate Coupon rate Coupon rate : Coupon rate: Enter the coupon rate of the bond only numeric characters and a decimal point, no percent sign. Compound: Compounding: Rate compounding interval: Coupon rate compounding interval: Coupon rate compounding interval Select the compounding frequency of the coupon rate. Mkt rate Market rate Current market rate Current market rate of similar bonds : Current market rate of similar bonds: Enter the current market rate that a similar bond is selling for only numeric characters and a decimal point, no percent sign.

Yrs to mat Yrs to maturity Years to maturity Years to maturity : Years to maturity: Enter the number of years remaining before the bond reaches its maturity date whole numbers only. Years to maturity No text. Bond value: Bond value: Bond value: Bond value: Bond value: Given the face value, coupon rate, coupon compounding interval, years to maturity, and the current market rate, this is the price your bond would be trading at.

Related Calculators. Other Section Calculators. Show Help and Tools. Instructions Terms Data PCalc. What is Bond Valuation? Bond valuation is a method used to determine the expected trading price of a bond.

- coupons for busy bee jumpers;

- karen kane coupons;

- Yield to Call Calculator?

- california region coupons;

- Find the best rates for...;

- scotch-brite shower & bath scrubber coupon;

- Fixed Income Investor - Bond Prices & Yields - Bond Prices & Yields.

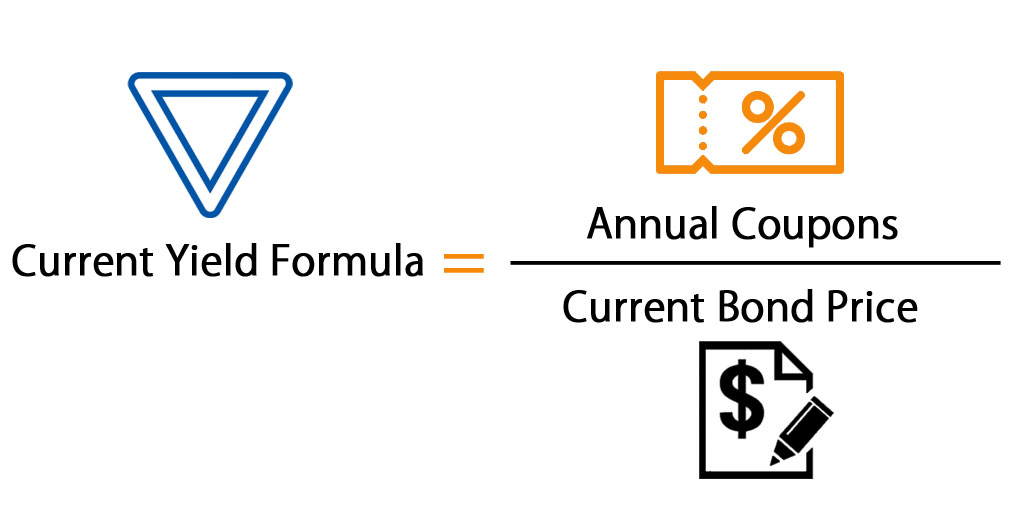

In this example, multiply 5 percent, or 0. Concluding the example, multiply 0. This yield is lower than its 5 percent coupon because its sells at a premium to par value. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Bond Pricing Formula

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Visit performance for information about the performance numbers displayed above.

Skip to main content. Step 2 Divide the price by Video of the Day.